Cryptocurrency trading has attracted a large number of users in recent years. With the development of the crypto economy, new opportunities are emerging for those who want to make money with digital assets. For Russians, the choice of a platform plays an important role in the safe and convenient exchange and trading of currencies. Given the instability of traditional financial markets and the increasing availability of new investment opportunities such as Bitcoin, Ethereum and Tether for citizens, it is important to choose a reliable platform that can provide stability and favorable conditions.

In this article, you will find the best crypto exchanges for Russians that are worth considering, as well as a detailed overview of their features, functions and advantages.

How to choose the best cryptocurrency exchange for Russians in 2025?

The first thing you should consider when choosing a platform is security. The best crypto exchanges for Russians should offer reliable asset protection mechanisms. It is important that the platform uses two-factor authentication, data encryption and DDoS protection. Some services also offer insurance against losses in the event of a hack attack.

A significant advantage is low fees. If you trade regularly, high fees can reduce your total profit. The best cryptocurrency exchanges offer competitive fees and discounts for platform activity. Some services offer the ability to exchange cryptocurrencies for fiat currencies such as rubles or dollars, which is convenient for users in Russia. This is important because it allows assets to be exchanged directly for local currencies, without having to resort to external exchange services.

The liquidity of an exchange directly affects the ability to complete transactions at a favorable price. The higher the parameter, the easier it is to buy or sell an asset at market value. Platforms with high trading volume and high liquidity are suitable for experienced traders and those who want to work with large volumes. The user interface of the website should be user-friendly and intuitive. For beginners, easy navigation and the availability of training materials are important. A mobile app allows users to monitor transactions and manage assets at any time.

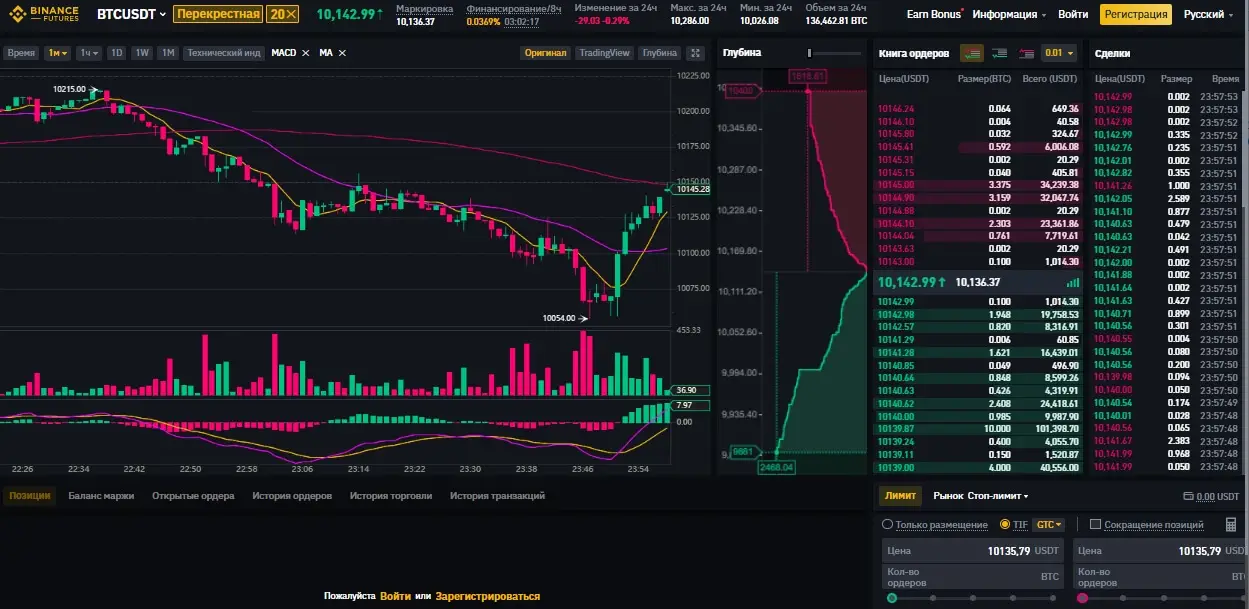

1. Binance is a universal exchange with extensive functionality.

Binance is the largest cryptocurrency exchange by trading volume. The platform offers a wide range of digital assets, including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and less popular altcoins.

Binance is the largest cryptocurrency exchange by trading volume. The platform offers a wide range of digital assets, including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and less popular altcoins.

Budget:

- Fiat currency support: ruble support via P2P exchange.

- Commissions: Trading commissions start at 0.10% for each participant.

- Interface: accessible to beginners and professionals.

- Features: Margin trading, futures, staking, and the ability to earn passive income through cryptocurrency faucets.

- Download the app: available for Android and iOS.

Pros:

- High liquidity.

- Large selection of trading pairs.

- Ease of use.

2. ByBit: ideal for derivatives trading

ByBit is one of the best crypto exchanges for Russians, focused on derivatives trading such as futures contracts and margin trading. It is suitable for experienced traders who want to make money from cryptocurrency price fluctuations.

Budget:

- Fiat currency support: P2P exchange is possible.

- Commission: from 0.075% per transaction.

- User interface: Easy to use for experienced traders, but can be difficult for beginners.

- Features: Low commissions for margin and futures trading, hedging support.

Pros:

- Wide selection of trading instruments.

- Margin trading with up to 100x leverage.

- Low fees.

3. Gate.io: Extensive support for altcoins

Gate.io is a platform with a large selection of altcoins. For Russian users, it offers convenient P2P trading and the ability to exchange cryptocurrencies for rubles.

Budget:

- Fiat currency support: P2P exchange for Russian citizens.

- Commissions: Initial commission is 0.20% but can decrease depending on trading volume.

- Interface: Convenient for beginners and professionals.

- Features: Futures trading, margin trading, staking.

Pros:

- Large selection of altcoins.

- Simple user interface.

- Support for various trading strategies.

4. OKX – for professionals and institutional investors

OKX is aimed at professional traders and institutional investors and offers various tools for analysis and trading.

Budget:

- Fiat currency support: supports rubles via P2P.

- Commissions: from 0.10% per transaction.

- Interface: Multifunctional and suitable for advanced users.

- Features: Advanced analysis tools, margin trading, staking.

Advantages:

- High level of security.

- Many analysis tools.

- Support for professional traders.

5. MEXC – attractive for beginners

MEXC is a profitable exchange for Russians with a simple interface and the lowest commissions for beginners. It offers basic functions for cryptocurrency trading.

Budget:

- Fiat currency support: P2P platform for Russians.

- Commission: from 0.20%.

- User interface: Made as simple as possible for beginners in trading.

- Features: Trade a wide range of cryptocurrencies, options and futures.

Advantages:

- Easy user interface.

- Low fees.

- Good support for beginners.

Selection of the best cryptocurrency exchanges for Russians

Russian traders have access to numerous platforms with different conditions. The best cryptocurrency exchanges for Russians offer security, low fees and a user-friendly interface. When choosing a platform, it is important to consider aspects such as support for fiat currencies, altcoins, liquidity and functionality. Today, exchanges such as Binance, ByBit, Gate.io, OKX and MEXC are considered the best solutions for Russian users, as they offer favorable conditions for trading digital assets.

Russian traders have access to numerous platforms with different conditions. The best cryptocurrency exchanges for Russians offer security, low fees and a user-friendly interface. When choosing a platform, it is important to consider aspects such as support for fiat currencies, altcoins, liquidity and functionality. Today, exchanges such as Binance, ByBit, Gate.io, OKX and MEXC are considered the best solutions for Russian users, as they offer favorable conditions for trading digital assets.

Asset protection is an area where no concessions can be made. A strong exchange implements cold storage for at least 90% of customer assets, applies multi-factor authentication, supports address whitelists, and has an insurance reserve. In 2024, the average damage caused by cyber attacks exceeded $2 billion. The security of cryptocurrency exchanges in 2025 therefore requires not a formal approach, but technical personnel. A reliable cryptocurrency exchange displays open audit reports, collaborates with cybersecurity teams, and implements constant monitoring to detect abnormal activity.

Asset protection is an area where no concessions can be made. A strong exchange implements cold storage for at least 90% of customer assets, applies multi-factor authentication, supports address whitelists, and has an insurance reserve. In 2024, the average damage caused by cyber attacks exceeded $2 billion. The security of cryptocurrency exchanges in 2025 therefore requires not a formal approach, but technical personnel. A reliable cryptocurrency exchange displays open audit reports, collaborates with cybersecurity teams, and implements constant monitoring to detect abnormal activity. Choosing the right cryptocurrency exchange is an important part of the strategy for 2025. The platform determines the protection of capital, ease of use, flexibility of trading solutions and the speed with which financial goals are achieved. The selection criteria for cryptocurrency exchanges include technical stability, transparency, reach, support, licences and security level. Errors at this stage lead to immediate risks of losses.

Choosing the right cryptocurrency exchange is an important part of the strategy for 2025. The platform determines the protection of capital, ease of use, flexibility of trading solutions and the speed with which financial goals are achieved. The selection criteria for cryptocurrency exchanges include technical stability, transparency, reach, support, licences and security level. Errors at this stage lead to immediate risks of losses.

Price developments over the next two years will depend on a combination of macroeconomic and technological factors. The price forecast for bitcoin is based on an analysis of the upcoming halving, the increase in institutional participation and regulatory dynamics. The expected reduction in the reward to 3.125 BTC per block, while maintaining the current hash rate, will create a supply shortage. At the same time, demand from ETF platforms, funds, and banking products with cryptographic coverage will stimulate continued growth.

Price developments over the next two years will depend on a combination of macroeconomic and technological factors. The price forecast for bitcoin is based on an analysis of the upcoming halving, the increase in institutional participation and regulatory dynamics. The expected reduction in the reward to 3.125 BTC per block, while maintaining the current hash rate, will create a supply shortage. At the same time, demand from ETF platforms, funds, and banking products with cryptographic coverage will stimulate continued growth. Predicting the behaviour of BTC without analysing the market structure means relying on chance. When predicting the price of Bitcoin, it is important to consider not only the chart but also the fundamental factors. The technological basis, the economic role, the psychological component… it all influences the value. The advantage does not go to those who guess the figure, but to those who understand the mechanics. The long-term growth of BTC does not rule out short-term declines. But limited supply, institutional demand and demand for digital protection create a powerful growth vector.

Predicting the behaviour of BTC without analysing the market structure means relying on chance. When predicting the price of Bitcoin, it is important to consider not only the chart but also the fundamental factors. The technological basis, the economic role, the psychological component… it all influences the value. The advantage does not go to those who guess the figure, but to those who understand the mechanics. The long-term growth of BTC does not rule out short-term declines. But limited supply, institutional demand and demand for digital protection create a powerful growth vector.

This type of transaction does not require the transfer of assets between exchanges. Cryptocurrency arbitrage within an exchange uses the differences between trading pairs on the same platform. Example: On Binance, the BTC/USDT price differs from the BTC/BUSD price. Arbitrage occurs when there is an equilibrium of liquidity in individual order books.

This type of transaction does not require the transfer of assets between exchanges. Cryptocurrency arbitrage within an exchange uses the differences between trading pairs on the same platform. Example: On Binance, the BTC/USDT price differs from the BTC/BUSD price. Arbitrage occurs when there is an equilibrium of liquidity in individual order books. Arbitrage does not require trend forecasting, does not depend on news, and is not based on confidence in asset growth. Each format is based on calculation logic, speed, and precision. Cryptocurrency arbitrage strategies are not just a set of strategies, but a tool for portfolio diversification.

Arbitrage does not require trend forecasting, does not depend on news, and is not based on confidence in asset growth. Each format is based on calculation logic, speed, and precision. Cryptocurrency arbitrage strategies are not just a set of strategies, but a tool for portfolio diversification.

Most traders operate on centralized exchanges such as Binance, Bybit, Kraken, OKX, KuCoin. The platforms offer easy registration, a user-friendly interface and high liquidity. However, they manage users’ funds, which entails risks in the event of piracy or financial problems for the source.

Most traders operate on centralized exchanges such as Binance, Bybit, Kraken, OKX, KuCoin. The platforms offer easy registration, a user-friendly interface and high liquidity. However, they manage users’ funds, which entails risks in the event of piracy or financial problems for the source. To decide which exchange and how to trade cryptocurrencies, you should carefully analyze its security criteria, liquidity, reputation, and trading conditions. The optimal platform should offer asset protection, easy withdrawals, and favorable fees. Mistakes in selection can lead to financial loss, blocked funds, or problems with withdrawing them. Therefore, before registering, it is important to study the exchange’s terms and conditions, check its history, and test its functionality.

To decide which exchange and how to trade cryptocurrencies, you should carefully analyze its security criteria, liquidity, reputation, and trading conditions. The optimal platform should offer asset protection, easy withdrawals, and favorable fees. Mistakes in selection can lead to financial loss, blocked funds, or problems with withdrawing them. Therefore, before registering, it is important to study the exchange’s terms and conditions, check its history, and test its functionality.

Bybit remains the flagship among active trading platforms. The exchange serves over 20 million users and offers enhanced security through two-factor authentication and cold storage of assets. Bybit supports over 500 trading pairs, including BTC/USDT, ETH/USDT, SOL/USDT, and popular altcoins. The average daily trading volume exceeds $15 billion.

Bybit remains the flagship among active trading platforms. The exchange serves over 20 million users and offers enhanced security through two-factor authentication and cold storage of assets. Bybit supports over 500 trading pairs, including BTC/USDT, ETH/USDT, SOL/USDT, and popular altcoins. The average daily trading volume exceeds $15 billion. Choosing the best cryptocurrency exchange in 2025 depends on the user’s goals, trading strategy, and educational level. The platforms presented in the review offer a variety of options: some are aimed at institutional clients and professional traders, others provide convenient conditions for beginners, and still others offer innovative tools for automated trading.

Choosing the best cryptocurrency exchange in 2025 depends on the user’s goals, trading strategy, and educational level. The platforms presented in the review offer a variety of options: some are aimed at institutional clients and professional traders, others provide convenient conditions for beginners, and still others offer innovative tools for automated trading.

To choose the right platform for trading cryptocurrencies, it is necessary to understand the strengths and weaknesses of each model. Centralized and decentralized exchanges offer different features: some focus on convenience and scalability, while others focus on security and decentralization. Let’s analyze the pros and cons.

To choose the right platform for trading cryptocurrencies, it is necessary to understand the strengths and weaknesses of each model. Centralized and decentralized exchanges offer different features: some focus on convenience and scalability, while others focus on security and decentralization. Let’s analyze the pros and cons. Centralized and decentralized exchanges are two different approaches to interacting with cryptocurrencies. Some offer comfort and support, others freedom and control. By combining solutions, you can minimize risk and operate effectively in the market. By analyzing the features of the platforms and thinking about your goals, you can choose the optimal strategy for successful trading.

Centralized and decentralized exchanges are two different approaches to interacting with cryptocurrencies. Some offer comfort and support, others freedom and control. By combining solutions, you can minimize risk and operate effectively in the market. By analyzing the features of the platforms and thinking about your goals, you can choose the optimal strategy for successful trading.

Liquidity defines how quickly a cryptocurrency can be bought or sold at the current market price without significant slippage losses. High liquidity on a cryptocurrency trading platform ensures that transactions are executed immediately and at a favourable price.

Liquidity defines how quickly a cryptocurrency can be bought or sold at the current market price without significant slippage losses. High liquidity on a cryptocurrency trading platform ensures that transactions are executed immediately and at a favourable price. Choosing a reliable cryptocurrency trading platform requires attention to detail. How do you choose a cryptocurrency exchange that offers security, low commissions and convenience? Taking into account the interface, liquidity, security and support for ruble transactions, you can choose a platform suitable for any strategy. Following these recommendations will make cryptocurrency trading more efficient and secure.

Choosing a reliable cryptocurrency trading platform requires attention to detail. How do you choose a cryptocurrency exchange that offers security, low commissions and convenience? Taking into account the interface, liquidity, security and support for ruble transactions, you can choose a platform suitable for any strategy. Following these recommendations will make cryptocurrency trading more efficient and secure.

Coinbase is one of the most trusted cryptocurrency exchanges, targeting users who value security and ease of use. Founded in 2012 in the United States, the company is regulated by financial authorities and licensed to operate in multiple jurisdictions. The average daily trading volume is around $2 billion.

Coinbase is one of the most trusted cryptocurrency exchanges, targeting users who value security and ease of use. Founded in 2012 in the United States, the company is regulated by financial authorities and licensed to operate in multiple jurisdictions. The average daily trading volume is around $2 billion. Choosing a trading platform will determine your success in the cryptocurrency world. The best crypto exchanges offer high security standards, a wide range of instruments and assets, and user-friendly interfaces for traders of all levels. Choose trusted industry leaders so you can trade with confidence.

Choosing a trading platform will determine your success in the cryptocurrency world. The best crypto exchanges offer high security standards, a wide range of instruments and assets, and user-friendly interfaces for traders of all levels. Choose trusted industry leaders so you can trade with confidence.

Kraken stands out as one of the best cryptocurrency exchanges of 2024 thanks to its powerful platform that caters to experienced traders. Founded in 2011, Kraken was one of the first crypto exchanges to offer margin and futures trading. The platform supports over 60 cryptocurrencies, including popular assets like Bitcoin, Ethereum, and Litecoin.

Kraken stands out as one of the best cryptocurrency exchanges of 2024 thanks to its powerful platform that caters to experienced traders. Founded in 2011, Kraken was one of the first crypto exchanges to offer margin and futures trading. The platform supports over 60 cryptocurrencies, including popular assets like Bitcoin, Ethereum, and Litecoin. The best cryptocurrency exchanges of 2024 demonstrate a high level of innovation, security, and ease of use. Choosing the right platform plays a key role in successfully trading and managing crypto assets. Explore the suggested exchanges based on your needs and preferences to find the perfect platform for cryptocurrency trading.

The best cryptocurrency exchanges of 2024 demonstrate a high level of innovation, security, and ease of use. Choosing the right platform plays a key role in successfully trading and managing crypto assets. Explore the suggested exchanges based on your needs and preferences to find the perfect platform for cryptocurrency trading.

Despite all the successes, the cryptocurrency market remains extremely volatile. It is important for a beginner to understand the basic principles and not panic during periods of strong price fluctuations.

Despite all the successes, the cryptocurrency market remains extremely volatile. It is important for a beginner to understand the basic principles and not panic during periods of strong price fluctuations. Trading cryptocurrencies on the stock exchange is not a risky game, but it does offer a real opportunity to make money if you approach it wisely. By following proven methods and approaches, you can minimize risks and increase your chances of success.

Trading cryptocurrencies on the stock exchange is not a risky game, but it does offer a real opportunity to make money if you approach it wisely. By following proven methods and approaches, you can minimize risks and increase your chances of success.

Coinbase is like your first bike: easy to use, secure, and reliable. The top-listed cryptocurrency exchange is geared toward beginners and offers an intuitive interface. It’s one of the most popular exchanges in the world, especially in the United States, and one of the safest.

Coinbase is like your first bike: easy to use, secure, and reliable. The top-listed cryptocurrency exchange is geared toward beginners and offers an intuitive interface. It’s one of the most popular exchanges in the world, especially in the United States, and one of the safest. It’s not a matter of preference, but of strategy: the 7 best cryptocurrency exchanges in 2024 show that each platform offers unique opportunities for different categories of traders. The choice depends on the goals: beginners can start with Coinbase, experienced traders will appreciate the capabilities of Binance or Kraken, and for derivatives enthusiasts, Bybit or OKX will be the ideal choice.

It’s not a matter of preference, but of strategy: the 7 best cryptocurrency exchanges in 2024 show that each platform offers unique opportunities for different categories of traders. The choice depends on the goals: beginners can start with Coinbase, experienced traders will appreciate the capabilities of Binance or Kraken, and for derivatives enthusiasts, Bybit or OKX will be the ideal choice.